Over 50% of Americans were covered by some form of life insurance in 2020. Having proper coverage for you and your family after your passing has always been important, but understanding how it all works can be tough.

When it comes to picking life insurance policies, what should I look out for? How do I choose the right life insurance policy options?

That’s what we’re here to look at today. Read on to find out 5 crucial factors for picking life insurance policies.

1. Know How Much Insurance You’ll Need

The first factor you should look out for when choosing life insurance is the amount you actually need to be covered. Knowing the amount of capital you’ll leave behind is crucial to choosing the right coverage.

How much debt will you have? Have you paid off your student loans? Your mortgage?

Do you want to replace your income for the rest of your children or your spouse’s lives? If you have dependents, you might also want to fund their education as well.

This all factors into calculating the amount of life insurance you need. Consulting your potential life insurance provider about your coverage amount is therefore crucial.

2. How Long Will You Need Coverage?

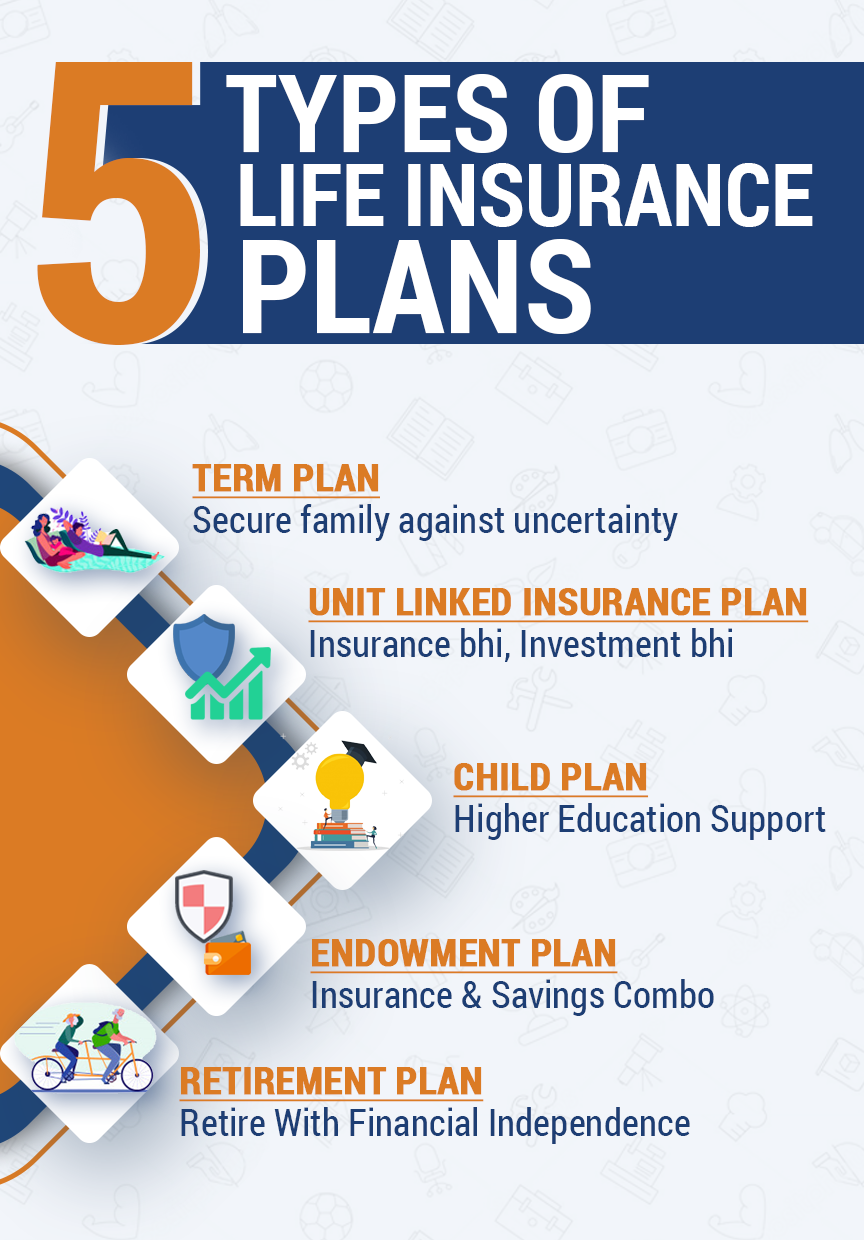

Life insurance either lasts an entire lifetime or just a short period of time. Considering how long you need your insurance to last is crucial for any given situation.

If you want to pay for your family’s expenses for a specific period of time, choose term insurance. If you need coverage for your entire lifetime, choose whole or permanent insurance.

3. Choose The Right Premium Amount

Another crucial factor to your life insurance is your premium amount. It’s very possible to overpay for your premium if you get a plan that offers more than you or your family need.

Look at your premium and all the benefits you get and decide whether that’s really the right amount. After all, you don’t want to overpay for things that your dependents won’t have use for.

4. Name Beneficiaries

Beneficiaries are individuals who’ll receive the benefits of your life insurance policy. Consult your lawyer or other agents when naming your beneficiaries since it can get a little complicated.

Naming children or your estate, for example, can get complex and are often not advised. As such, speaking with an independent agent is the best move here before choosing an insurance policy.

5. Think About Every Goal

Life insurance policies often have cash values that increase over time. You might also get a death benefit or face amount at the time of your death.

As such, life insurance can be used as savings for either you or your family members. When buying life insurance, consider these factors as you go along.

Paradigm Life has a great resource for understanding the cash value of whole insurance. Check it out if you aren’t sure how it all works.

Picking Life Insurance Policies The Right Way

Picking life insurance policies can feel like a daunting task for something that’s way down the line. Use this article to understand ways you can choose the best option in a timely and effective manner.

For more information on personal finance and insurance, check out the rest of our site!